The United States of Broke

Rising costs, stagnant wages, and growing debt have made it harder than ever for Americans to stay financially afloat. But depending on where you live, your odds of going broke might be much higher than you think.

We combined fresh data on income, debt, bankruptcy rates, cost of living, and savings buffers to rank the states where residents are most at risk of financial collapse in 2026.

And they are...

30: Alaska

30: Alaska

Median income: High vs. U.S.; volatile year-to-year

Average debt per resident: Above U.S. average

Bankruptcy rate: Low–moderate

Cost of living: Well above U.S. average

Liquid-asset poverty: Mid-high tier

A strong income is blunted by sky-high prices and heavy household balances—especially vehicles and mortgages.

Jack Connaher, Wikimedia Commons

Jack Connaher, Wikimedia Commons

29: Colorado

Median income: Above average

Average debt per resident: High (mortgage-heavy)

Bankruptcy rate: Low–moderate

Cost of living: Above U.S. average

Liquid-asset poverty: Mid tier

Boomtown costs and big leverage can still sink middle-income households without robust cash buffers.

28: Illinois

Median income: Near U.S. average

Average debt per resident: High

Bankruptcy rate: High (relative to peers)

Cost of living: Slightly above U.S.

Liquid-asset poverty: Mid-high tier

Chicago-area expenses and higher filing activity keep financial stress elevated.

Ken Lund from Reno, Nevada, USA, Wikimedia Commons

Ken Lund from Reno, Nevada, USA, Wikimedia Commons

27: Washington

Median income: High

Average debt per resident: High

Bankruptcy rate: Low

Cost of living: Above U.S. average

Liquid-asset poverty: Mid tier

Tech wages help, but housing and consumer balances leave many one bad month from red.

Carol M. Highsmith, Wikimedia Commons

Carol M. Highsmith, Wikimedia Commons

26: Oregon

Median income: Near-above average

Average debt per resident: High

Bankruptcy rate: Mid

Cost of living: Above U.S. average

Liquid-asset poverty: Mid-high tier

Price levels and card balances keep budgets taut even with decent pay.

Fcb981, edit by --Digon3 talk, Wikimedia Commons

Fcb981, edit by --Digon3 talk, Wikimedia Commons

25: Pennsylvania

Median income: Near U.S. average

Average debt per resident: Mid-high

Bankruptcy rate: Mid

Cost of living: Near U.S.

Liquid-asset poverty: Mid-high tier

Stable incomes meet rising non-mortgage debt and thin rainy-day funds.

Popscreenshot, Wikimedia Commons

Popscreenshot, Wikimedia Commons

24: Ohio

Median income: Below U.S. average

Average debt per resident: Mid

Bankruptcy rate: High

Cost of living: Below U.S.

Liquid-asset poverty: High tier

Lower prices help, but filing rates and limited liquidity elevate risk.

Pi.1415926535, Wikimedia Commons

Pi.1415926535, Wikimedia Commons

23: Michigan

Median income: Near U.S. average

Average debt per resident: Mid-high (auto-heavy)

Bankruptcy rate: High

Cost of living: Below–near U.S.

Liquid-asset poverty: High tier

Auto debt and higher filings keep cash flow fragile.

Crisco 1492, Wikimedia Commons

Crisco 1492, Wikimedia Commons

22: Indiana

Median income: Below U.S. average

Average debt per resident: Mid

Bankruptcy rate: High

Cost of living: Below U.S.

Liquid-asset poverty: High tier

Cheap living can’t fully offset weak cushions and filing intensity.

Carol M. Highsmith, Wikimedia Commons

Carol M. Highsmith, Wikimedia Commons

21: North Carolina

Median income: Near U.S.

Average debt per resident: Mid-high

Bankruptcy rate: Mid

Cost of living: Near U.S. (rising metros)

Liquid-asset poverty: Mid-high tier

Fast-growing metros bring higher bills; many households remain cash-light.

Harrison Keely, Wikimedia Commons

Harrison Keely, Wikimedia Commons

20: Massachusetts

Median income: Very high

Average debt per resident: High

Bankruptcy rate: Low

Cost of living: Far above U.S.

Liquid-asset poverty: Mid tier

Elite incomes, but prices and leverage make small shocks expensive.

19: New Jersey

Median income: Very high

Average debt per resident: Very high (mortgage-heavy)

Bankruptcy rate: Low

Cost of living: Far above U.S.

Liquid-asset poverty: Mid tier

Housing costs and big balances keep risk real despite paychecks.

King of Hearts, Wikimedia Commons

King of Hearts, Wikimedia Commons

18: New York

Median income: Above U.S. average

Average debt per resident: High

Bankruptcy rate: Low–mid

Cost of living: Very high

Liquid-asset poverty: Mid-high tier

Sky-high prices and thin savings among renters make NYC-area budgets precarious.

Clement Bardot, Wikimedia Commons

Clement Bardot, Wikimedia Commons

17: Texas

Median income: Near U.S.

Average debt per resident: High

Bankruptcy rate: Mid–high in several districts

Cost of living: Slightly below U.S. (rising in metros)

Liquid-asset poverty: High tier

Leverage and weak savings buffers outweigh only-modest price relief.

16: Arizona

Median income: Near U.S.

Average debt per resident: High

Bankruptcy rate: Mid

Cost of living: Above U.S. (metro-driven)

Liquid-asset poverty: Mid-high tier

Sunbelt migration brought costs and balances that strain newcomers.

unknown; cleaned up, rotated and levels adjustment by Howcheng., Wikimedia Commons

unknown; cleaned up, rotated and levels adjustment by Howcheng., Wikimedia Commons

15: Kentucky

Median income: Low

Average debt per resident: Mid

Bankruptcy rate: High

Cost of living: Below U.S.

Liquid-asset poverty: High tier

Even with cheaper prices, low income and filings keep risk elevated.

Ken Lund from Reno, Nevada, USA, Wikimedia Commons

Ken Lund from Reno, Nevada, USA, Wikimedia Commons

14: Oklahoma

Median income: Low–near U.S.

Average debt per resident: Mid

Bankruptcy rate: High

Cost of living: Below U.S.

Liquid-asset poverty: High tier

Volatile energy cycles and weak savings create quick trouble.

13: South Carolina

Median income: Below U.S.

Average debt per resident: Mid-high

Bankruptcy rate: High

Cost of living: Near U.S. (coastal premiums)

Liquid-asset poverty: High tier

Tourism metros lift prices; cushions lag behind.

12: Georgia

Median income: Near U.S.

Average debt per resident: High

Bankruptcy rate: High

Cost of living: Near U.S. (Atlanta costs rising)

Liquid-asset poverty: High tier

Card and auto balances plus filing intensity keep households fragile.

Frank Schulenburg, Wikimedia Commons

Frank Schulenburg, Wikimedia Commons

11: Tennessee

Median income: Below U.S.

Average debt per resident: Mid-high

Bankruptcy rate: Among highest

Cost of living: Below U.S. (Nashville above)

Liquid-asset poverty: High tier

One of the nation’s bankruptcy hot spots keeps risk near the top.

10: Alabama

Median income: Low

Average debt per resident: Mid

Bankruptcy rate: High

Cost of living: Below U.S.

Liquid-asset poverty: High tier

Thin incomes and weak cash buffers leave little room for error.

Carol M. Highsmith, Wikimedia Commons

Carol M. Highsmith, Wikimedia Commons

9: Arkansas

Median income: Low

Average debt per resident: Mid

Bankruptcy rate: High

Cost of living: Low

Liquid-asset poverty: High tier

Cheaper prices help, but savings gaps and filings dominate.

8: New Mexico

Median income: Low

Average debt per resident: Mid

Bankruptcy rate: Mid

Cost of living: Near U.S.

Liquid-asset poverty: High tier

Lower pay and thin cushions outweigh moderate prices.

Ron Reiring, Wikimedia Commons

Ron Reiring, Wikimedia Commons

7: California

Median income: High

Average debt per resident: Very high

Bankruptcy rate: Mid

Cost of living: Among highest

Liquid-asset poverty: Mid-high tier

Top-tier incomes can’t fully offset extreme housing and insurance costs and heavy leverage.

Marshall Astor from San Pedro, United States, Wikimedia Commons

Marshall Astor from San Pedro, United States, Wikimedia Commons

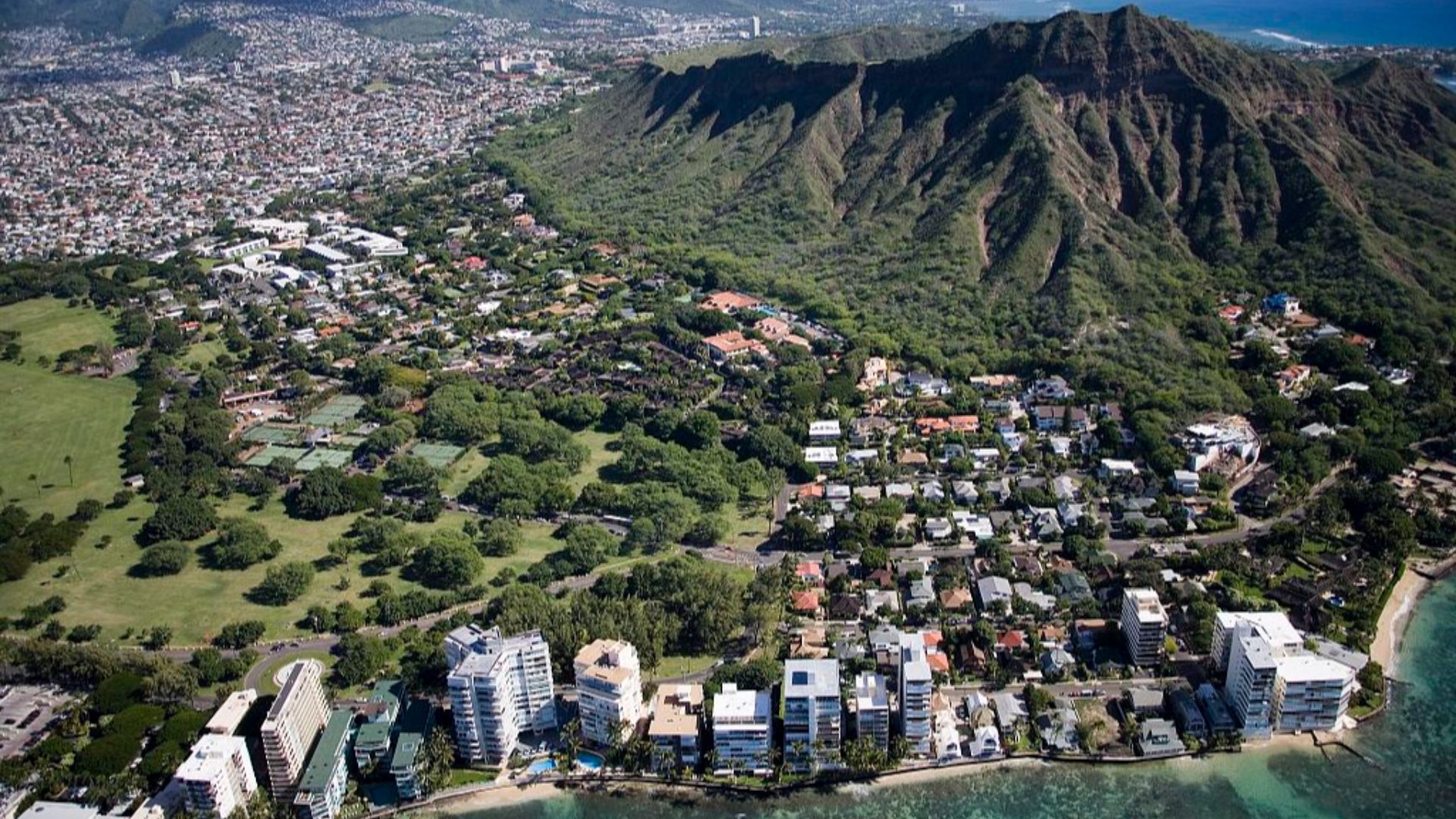

6: Hawaii

Median income: High

Average debt per resident: High

Bankruptcy rate: Low–mid

Cost of living: Highest tier

Liquid-asset poverty: Mid-high tier

Island prices keep even solid earners on a knife’s edge.

Highsmith, Carol M., 1946-, Wikimedia Commons

Highsmith, Carol M., 1946-, Wikimedia Commons

5: Florida

Median income: Below–near U.S.

Average debt per resident: High

Bankruptcy rate: Rising

Cost of living: Above U.S. (insurance shock)

Liquid-asset poverty: High tier

Insurance and housing spikes plus leverage and low buffers raise 2026 risk.

Clement Bardot, Wikimedia Commons

Clement Bardot, Wikimedia Commons

4: West Virginia

Median income: Very low

Average debt per resident: Mid

Bankruptcy rate: High

Cost of living: Low

Liquid-asset poverty: Very high

Chronic low incomes and weak savings overwhelm low prices.

Tim Kiser (w:User:Malepheasant), Wikimedia Commons

Tim Kiser (w:User:Malepheasant), Wikimedia Commons

3: Nevada

Median income: Near U.S.

Average debt per resident: High (credit-card and auto)

Bankruptcy rate: High/volatile

Cost of living: Above U.S. (housing swings)

Liquid-asset poverty: High tier

Tourism-cycle shocks and leverage keep households vulnerable.

Don Ramey Logan, Wikimedia Commons

Don Ramey Logan, Wikimedia Commons

2: Louisiana

Median income: Very low

Average debt per resident: Mid

Bankruptcy rate: High

Cost of living: Near U.S. (insurance rising)

Liquid-asset poverty: Very high

Low pay and minimal cash buffers push many to the edge.

Michael Maples, U.S. Army Corps of Engineers, Wikimedia Commons

Michael Maples, U.S. Army Corps of Engineers, Wikimedia Commons

1: Mississippi

Median income: Lowest in U.S.

Average debt per resident: Lower than U.S., but burdensome vs. income

Bankruptcy rate: Among highest

Cost of living: Below U.S.

Liquid-asset poverty: Highest tier

Even with cheaper prices, the combination of very low incomes, thin savings, and elevated filings makes Mississippi the most at-risk in 2026.

You Might Also Like:

Americans Are Fleeing Some States—Here’s Where They’re Moving Instead

Ranking The Best States For Fishing—According To Data

Every Reason Las Vegas Used To Be So Much Better In The 60s And 70s